MOBILE MONEY INDEPENDENT TESTING

Validate the performance of your mobile money platform using our latest technology

MOBILE MONEY CHALLENGES

Risk and Compliance teams that are responsible for mobile money face a particularly challenging task. The mobile money platform must deliver reliable services, comply with regulations, generate revenue, and prevent serious fraud.

Mobile Money Risk Management

With Mobile Money (MoMo) also known as e-Money having so many risk factors, the risk management team must consider the introduction of assurance tools.

Our risk-based approach utilises our test call generator (TCG) tools to replicate a user’s activity. Our strategy for testing and assurance depends on the risk area being assessed. Our controls cover risk areas such as service integrity, revenue assurance and fraud detection.

Our mobile money solution integrates with your existing risk and control management strategies, therefore enhancing your existing controls framework. To learn more about our risk and control management click here

Service Integrity 24/7

The mobile money platform will only work if there is mobile service. This is why ensuring good mobile network coverage is key when trying to attract new customers onto your mobile money platform.

Geographical risk-based assurance is a key consideration when setting up a mobile money test strategy. It is important to test population hotspots, but it may be necessary to also test the lesser populated areas for regulatory compliance.

Our network monitoring solutions are fully scalable, enabling you to test dozens of locations or just a few. Test network reliability around the clock 24/7 or focus testing at peak usage times when risk of failure is high.

Service integrity KPIs we provide for Mobile Money activities:

- Network availability

- Network accessibility

- Service accessibility

- Service integrity

- Service retainability

- Timely service delivery

Mobile Money Test Solution

Our TCGs are used to both send and receive mobile money payments using real SIMs. We record the end-to-end activity and verify the activities during the events to ±100ms. Our TCGs also use an independent time source to ensure any mobile money transaction details recorded are accurate. The data we record is fully auditable from both the originating and terminating party, meaning that investigations can easily be made into MoMo platform failures.

Anything that a real customer can do, our TCG can also do!

24/7 Monitoring

Supporting 5G, SIM multiplexing and eSIM using our latest generation of TCG

Established Risk Framework

A 'ready to go' Mobile Money control framework with KPIs as standard

Full User Activity Coverage

SIM Toolkit, Apps, USSD and SMS

Pro-active Testing

Test before (testbed), during and after network upgrades

Flexible Test Strategy

Including pre-defined risk scenarios and ‘build your own’

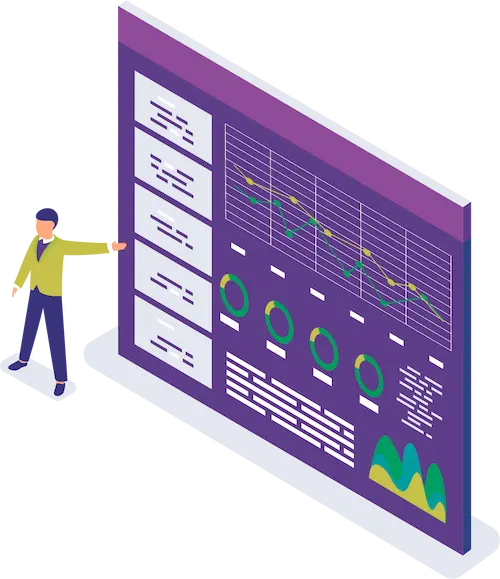

Flexible reporting

Dashboard summaries alongside detailed step-by-step test result data markers

Pushing Mobile Money To Its Limits

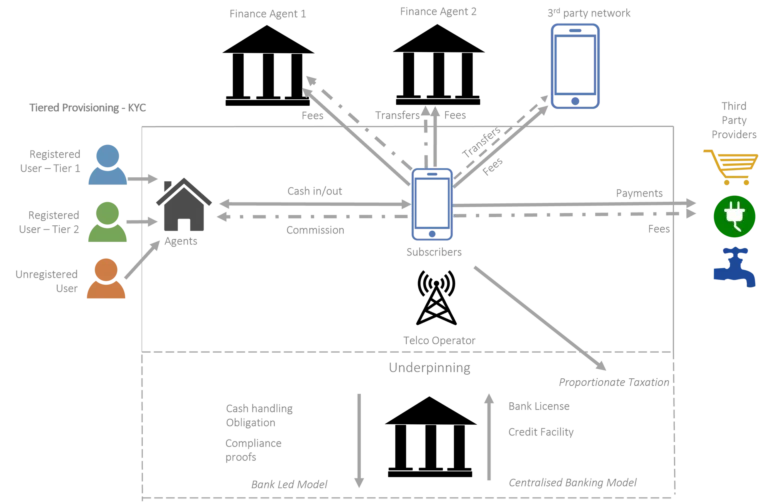

A test strategy/regime of money transfers can be designed to verify mobile money using TCG. Published Mobile Money business rules related to security and fraud prevention can be verified by testing limits and boundaries via the TCG.

Mobile Money Risk Scenarios Included

- Tiered KYC provisioning rules checking (limits to values and frequency)

- AML/CFT frequency and value limit rules for all tiers of provisioning

- Verify interoperability with Finance Institutions

- Verify interoperability with 3rd party mobile money providers

- Verify interoperability transaction fees

- Check PIN registration, rejection and blocking rules

- Ensure inactive account blocking rules, activity and credit limits

- Test USSD access code change controls and access catalogue definitions

- Transaction completion times

- App/fake app availability and functionality checking

- Interoperability transaction performance and completion times measured

- Interoperability function and timing tests for requests and acknowledgements

Complying With Regulatory Requirements

Two major risks of mobile money misuse are money laundering and terrorist financing. In some instances, regulations have been put in place (e.g. AML/KYC) to mitigate or reduce some of the risks. Our control framework supports governance best practices by monitoring and detecting for non-compliance. Our testing independently audits the MoMo fraud prevention business rules.

Book A Demo

Our demonstrations are flexible according to your needs. Ask questions or listen along, there are no obligations.