- REGTECH APPLICATIONS

PLATFORM PROVIDERS

TELECOM OPERATORS

REVENUE INTEGRITY

BUSINESS ASSURANCE

COMPLIANCE RISK

- Telecom Test Calls

- About Us

- How To Buy

Shining a light on fraud with forensic data reconciliations, analytics and reporting

Each year, industries suffer huge financial losses due to all kinds of fraud. Fraudster attack vectors can include weak business processes, missing controls, technical weaknesses or person misuse or corruption.

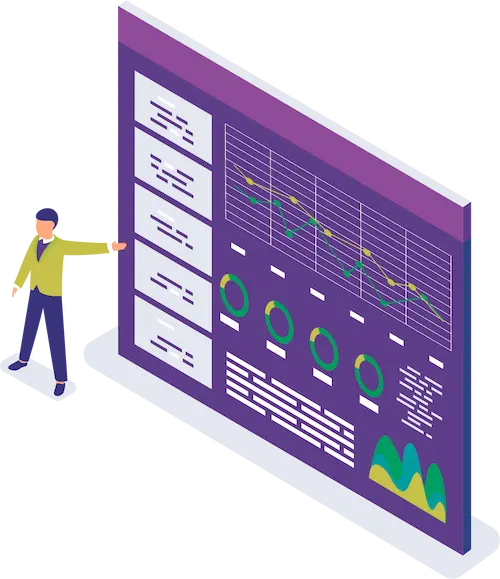

The ImperiumTM platform functions like the swiss army knife of all RegTech solutions. Its flexibility in decoding data enables the use of both internal and third party data sources to build a powerful fraud detection tool. With the data ‘in-hand’, the next step is applying a logical control framework that strains that data set until anomalies are identified. Alerts are then sent to initiate user-led investigations using the analytics and reconciliation features.

Once data is flowing into ImperiumTM, you can see a ‘birds eye’ view of the entire system environment in near real time (NRT). This end-to-end visibility allows for a thorough net to be spread over the data and find anomalies. Examples of the anomalies that can be found for further investigation:

Our solution can be adapted to your fraud assurance requirements. For example, you can define the KPI thresholds and alerts that should trigger internal action. In addition, these alerts can be uploaded directly into your own risk management portals. Alternatively, you can opt to use our pre-defined risk control framework.

Imperium™ can be used to enhance or replace existing core business assurance activities. It offers a variety of control modules that focus on key business areas, while also providing established risk frameworks that can be tailored to fit your business.