THE CHALLENGE

Revenue assurance teams are often tasked with the continuous monitoring and automated analysis of all customer accounts, usage and payment transactions.

All the Records, All the Time

Revenue assurance (RA) teams often find themselves using multiple data sources from various silos around the business. These data sources are often part of complicated ecosystems, with some data even having to be extracted manually. This can often hinder or prevent RA departments from seeing the whole picture when it comes to revenue integrity.

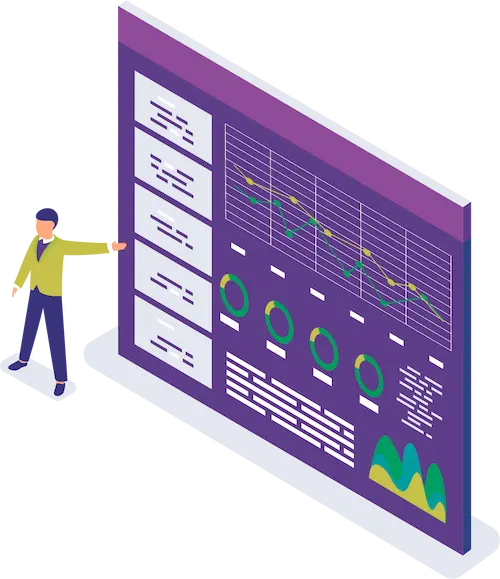

Once data is flowing into ImperiumTM, you can see a ‘birds eye’ view of the billing environment in near real time (NRT). The platform continuously monitors accuracy, timeliness and completeness of revenue streams by providing:

- High level financial overviews

- Usage breakdowns

- Record counts

- Adjustments

- Data feed integrity KPIs

- End-to-end reconciliation controls

- Promotions and discounts

- Transaction integrity KPIs

- Subscriber controls

- Prepay credit controls

- Revenue trending & patterns

- Order record flow latency

- Product KPIs controls

Our solution can be adapted to your revenue assurance requirements. For example, you can define the KPI thresholds and alerts that should trigger internal action. In addition, these alerts can be uploaded directly into your own risk management portals. Alternatively, you can opt to use our pre-defined risk control framework.

Imperium™ for Business Assurance

Imperium™ can be used to enhance or replace existing core business assurance activities. It offers a variety of control modules that focus on key business areas, while also providing established risk frameworks that can be tailored to fit your business.

Protecting Revenue and Identifying Leakage

eCommerce

- Webshop Front End Interface

- Picking Fulfilment

- Delivery & Last Mile Operations

Electricity

- Customer Set up & Management

- Meter Readings Rates & Tariff

- Payments & Collections

Telecom

- High level financial overview

- Usage breakdowns

- End-to-end reconciled controls

Request An Imperium™ Product Guide